2023

MACD launches cooperation with ifsam and another international fund broker, further expanding the fund trading offering for customers.

We welcome Sygnum to the MACD community as our second partner for trading digital assets at institutional level.

Introduction of the new asset class of art trading: In collaboration with ARTEX, the world's first art stock exchange, we offer all customers the opportunity to invest in a completely new, alternative asset class.

We set up photo shoots at our locations in Aachen (Germany) and Urdorf (Switzerland) and update our website with team photos, among other things.

2022

Introduction of a new asset class: Crypto Trading. MACD cooperates with the long-standing partner InCore Bank AG to offer trading in cryptocurrencies and other digital assets.

George Macdonald, CEO MACD has been working for MACD for 3 decades. Congratulations on your 30th anniversary!

2019-2021

MACD introduces a new asset class in 2019: Digitalised Order Transmission for Institutional Investors (MAX Custoner Connect)

MACD launches new MAX Order Management System in 2020. MAX is the successor to our long-standing products GLOX and XKYTE and will now gradually replace them.

Move to new data centres in Switzerland as well as the update of the entire software platform, renewal of all connectivity, modernisation of hardware takes place in 2021.

In the same year MACD introduces another asset class: Foreign Exchange Trading (MAX FX Trading)

2009-2018

OARIS launches the trading system XKYTE in 2009.

2011 Macdonald Associates launches the AIXECUTE exchange system, which has since been in use at BX Swiss and OTC-X (BEKB | BCBE). Macdonald Associates is officially renamed to MACD in 2013. In 2014 the EUREX connection goes live and MACD becomes a EUREX Application Service Provide (ASP).

Kurt Meister (OARIS) and George Macdonald have known each other for a long time and have already worked together on various projects. The financial IT companies MACD and OARIS bundle forces in 2017 and merge under the joint name MACD one year later. In the same year, MACD greatly expands its fund trading offering through cooperations with additional fund brokers.

2004-2008

Macdonald Associates becomes a member of the FIX Trading Community (formerly named FIX Protocol Limited) and begins providing support for QuickFIX.

FIX Trading Community is a not-for-profit association whose mission is to develop and maintain the world's predominant messaging standard for electronic trading, the FIX Protocol. The FIX Protocol can reduce inefficiencies and enable cost savings throughout the investment process - from investment managers to brokers, exchanges and regulators - which also benefits end investors.

2005 MACD and OARIS work together for the first time on a project for a Swiss private bank: MACD implements the stock exchange trading system and OARIS implements the core banking system connection.

Due to the increasing presence in Switzerland, George Macdonald establishes another company location in Maur (Switzerland). The managing director and customer account management work in a listed former electricity transformer station converted into offices, which was built in 1911 during the pioneering days of electricity. In the same year, the German development team in Aachen also moves to larger offices, which provide a stimulating atmosphere in a beautiful, centrally located building dating from 1893.

1999-2003

In 1999, George Macdonald founds Macdonald Associates GmbH in Aachen (Germany) and starts developing financial software for the first time. Together with his long-time colleague and friend Lucas Fowler (today Head of Software Engineering at MACD), they set up a development department in Aachen and from then on provide not just consulting, but also projects and products.

In the same year, Macdonald Associates GmbH launches the first software and interconnectivity tool "xConnect" with which different systems can be connected via defined business rules. The first customer, Deutsche Bank, chooses xConnect to interface between their Swiss and UK offices.

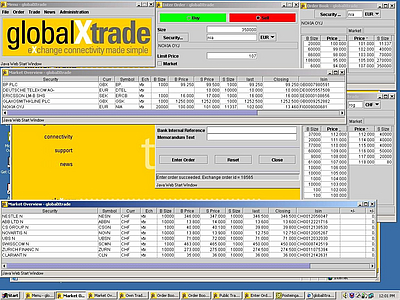

In 2001 the trading system "globalXtrade" (GLOX) is developed. GLOX is based on the base software "xConnect" and offers cost-effective, simple exchange connectivity via SIX Swiss Exchange (früher SWX Swiss Exchange). Connectivity is offered via a FIX interface and a Java trading front-end.

The first customer goes live with GLOX in 2022, initially connecting to virt-x, the SWX Swiss Exchange's pan-European segment. The exchange only allows hosted access for the blue chip segment at this time.

1994-1998

In 1994, Kurt Meister (today COO MACD) founds the company OARIS Consulting GmbH in Urdorf, Switzerland, with a partner. The first customer for software development is the Swiss Post. Later, OARIS also develops software solutions for market research and financial companies.

In 1995 the three stock exchanges of Geneva, Basel and Zurich merge and found the Swiss Stock Exchange Association under the name SWX Swiss Exchange (today SIX Swiss Exchange). In this year, George Macdonald returns to Aachen, Germany and resumes his consulting activities. 1996 he starts as a consultant for the SWX Swiss Exchange in Zurich to support the participant banks in the transition to electronic trading.

In 1998, George Macdonald and Kurt Meister get to know each other through their mutual client SWX Swiss Exchange in Zurich.

1983-1993

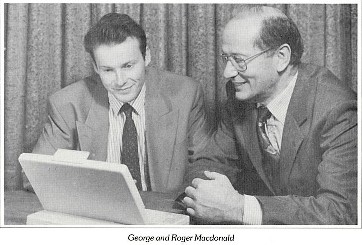

In 1983, Roger Macdonald, father of George Macdonald, founds Macdonald Associates Ltd in Reading, UK, offering software solutions for auctioneers (Macdonald Auctioneering Package).

After graduating from Manchester University with a degree in Computer Science 1989, George Macdonald starts his career in Aachen, Germany in 1989. He works on software projects for IBM (e.g. Valuta-IDS, FX trading system) and later also for Philips in Eindhoven, the Netherlands.

In 1992, George Macdonald goes into business for himself, becomes a shareholder in Macdonald Associates Ltd (today MACD) and immediately starts working full time for the family business.

The merger of MACD and OARIS in 2017 was the right step. Within a few years, our highly qualified employees have grown together to form a strong team that works across locations and complements each other perfectly. As the market leader for trading connectivity in Switzerland, we can effectively use the synergies for our customers, have introduced many new asset classes and developed a number of innovative products.

Kurt Meister, COO MACD