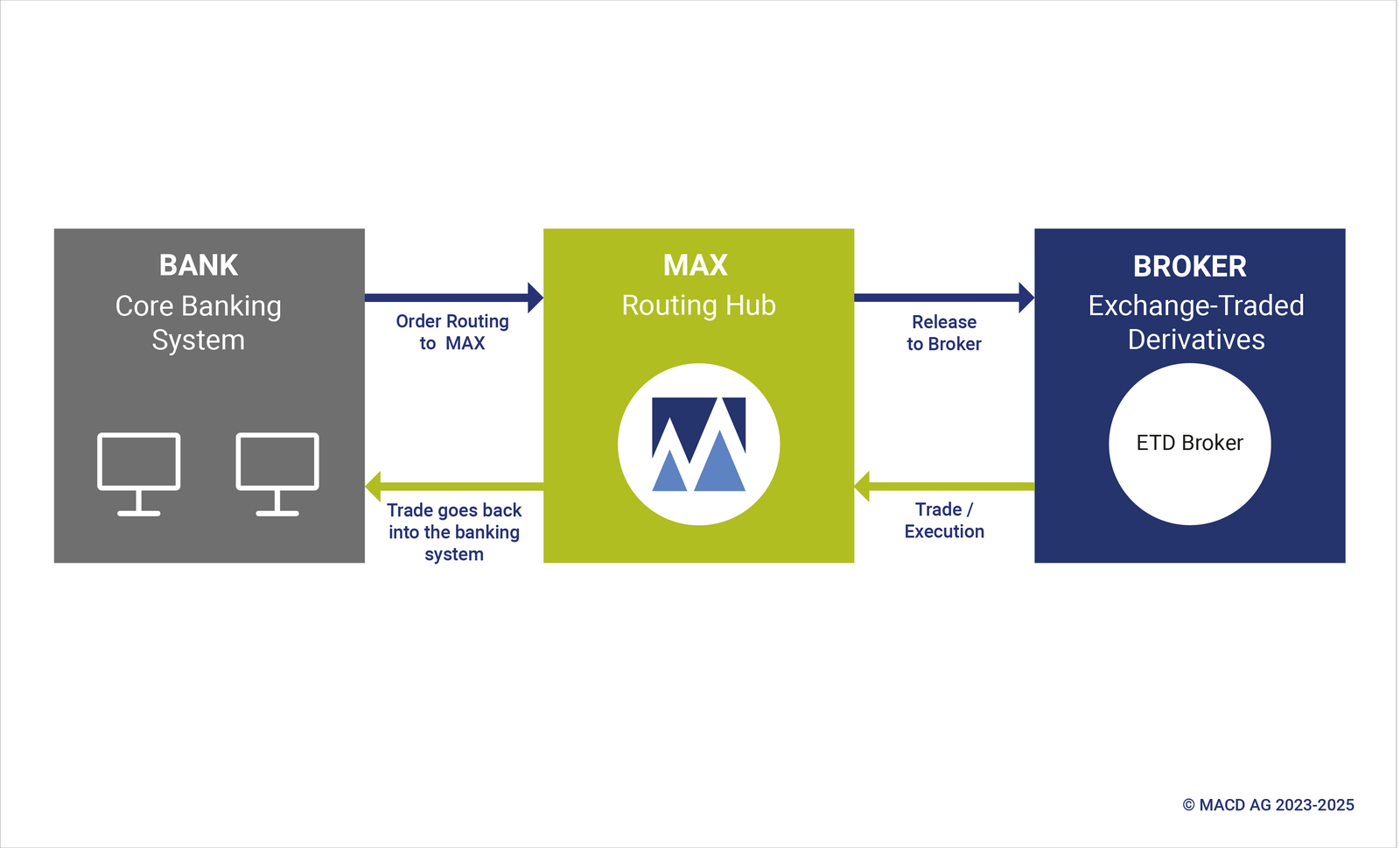

Fully automated connection

In cooperation with brokers in the MACD network, MACD offers routing of Exchange-Traded Derivatives (ETDs). This solution enables all MACD customers to trade automatically via the existing interface to their core banking system. Currently, Berner Kantonalbank and UBS are connected. Of course, the solution can also be offered with another broker of your choice.

Orders are routed via Straight Through Processing (STP) from the core banking system to the ETD broker via MAX Routing Hub or can be entered directly in the MAX Order Management System. Execution is fully automated back to the core banking system.

The advantages:

- Connection to existing infrastructure

- Reduction of workload due to a high degree of automation (STP)

- Available with or without GUI

- Configurable, rule-based release (error prevention)

- All orders in one system (no re-keying)

MACD Broker Program

Our ETD broker Berner Kantonalbank participates in the MACD Broker Program.

This offers you as a customer advantages: The broker takes over a not insignificant part of the annual fees, which means lower costs for you. Smaller changes on the part of the broker are implemented by MACD without cost consequences (e.g. algo parameters, FIX tag changes).