MAX Data Service is a functionality of our order management system MAX.

This service reduces complexity as well as effort and also allows you to flexibly customise your data streams.

The MAX Data Service includes two areas:

- Market Data (Market Data Service - MDS)

- Master Data (Global Instrument Service - GIS)

Market data enables the automated processing of orders in the MAX OMS, e.g. conditional orders, routing decisions. In addition, the subscribed market data is available in the GUI in real time.

For the direct feed of SIX market data (without using our Market Data Service) the SIX Swiss Exchange recommends a certain minimum bandwidth, which can lead to technological restructuring of the infrastructure and higher operating costs for the customer.

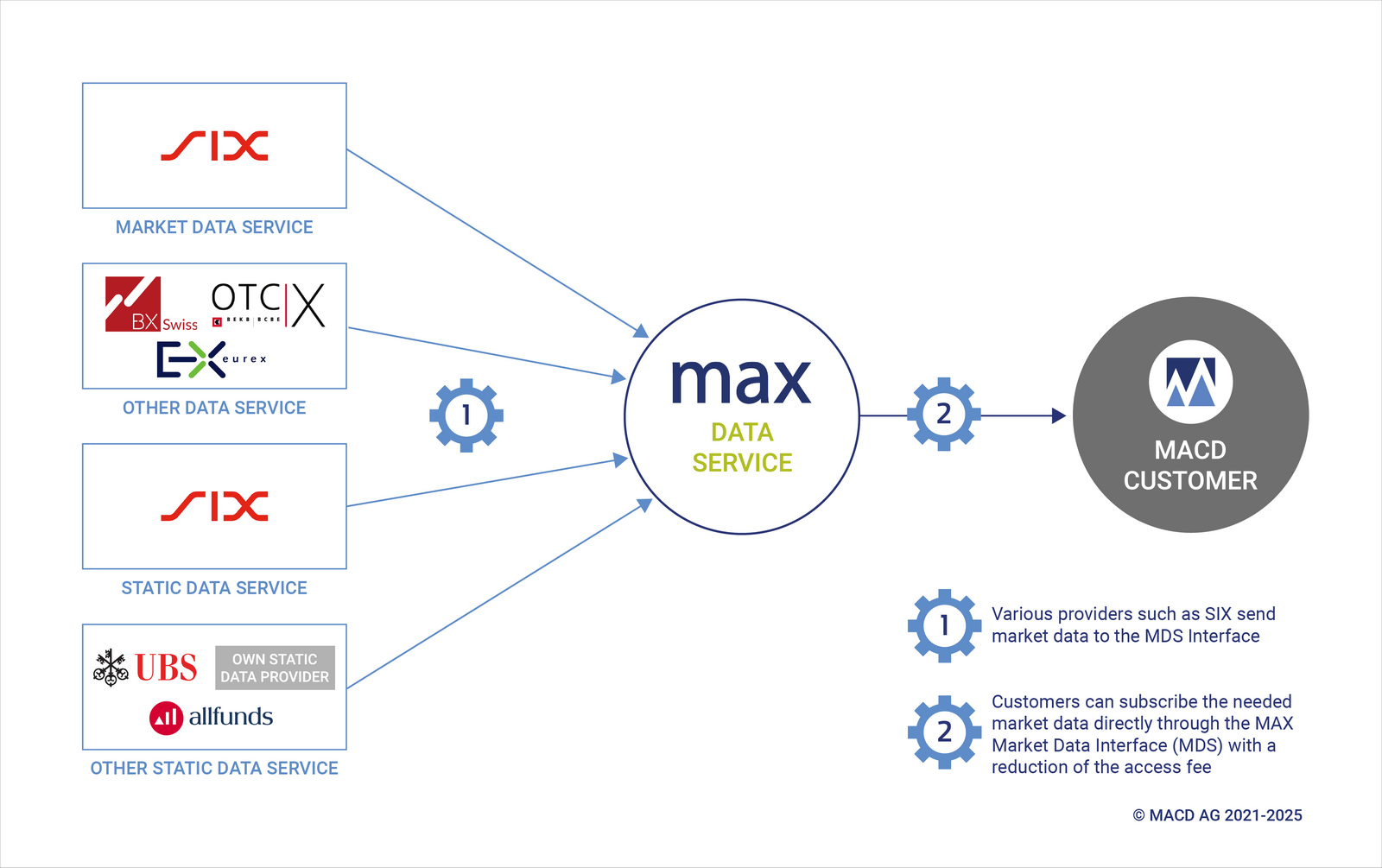

The Market Data Service (MDS) provides you lightweight access to SIX market data as well as a unified service that integrates other market data streams, e.g. Eurex, BX Swiss, OTC-X.

Via the scalable MDS Aggregator, we bundle for you the consolidated and standardised market data of all markets connected via MACD.

MACD therefore offers you a hosted solution with lower bandwidth requirements.

Master Data

The security master data gives the trader all information about the product they are trading.

All identification features such as ISIN, description or full name are displayed to the trader as conveniently as, for example, the expiration date of contracts or the accrued interest date of bonds.

Various rules can be set on master data (e.g. routing decisions, cut-off times for funds).

The MAX Master Data Service (Global Instrument Service, GIS) covers all instrument types from stocks to bonds to funds and offers maximum flexibility at low effort.

For this purpose, we have implemented a two-step concept: standardised master data are consolidated and integrated in a central GIS operated by MACD. Thus, generally available master data from markets, e.g. SIX and Eurex, as well as from brokers, e.g. UBS, are directly available to the customer.

In addition, master data from the banking system or other locally available sources of the customer can also be imported into MAX.

Flexible, Scalable & Reliable

The market data and master data can be displayed, accessed and used in the MAX Market GUI.

The MAX Market GUI and the MDS Aggregator are connected to the MDS in both data centres of MACD and therefore have a high reliability.

In addition, MDS and MDS Aggregator are scalable. Only the information requested by the customer is ever transmitted from the MDS. Multiple requests from a customer for the same instrument are bundled into one subscription by the MDS Aggregator. This optimises the number of subscriptions for the MDS and reduces the bandwidth required.

However, the MDS Aggregator could also be used in isolation to feed data into other systems of the bank (e.g. host or banking system, risk system).

Bloomberg Market Data Feed

The Bloomberg Market Data Feed enables the display of all real-time market data subscribed to Bloomberg in the MAX trading interface.

This helps the trader to keep an overall view of the markets, but also to make decisions on price limits of orders, which are then sent to the broker for execution.

In order to use this service, MAX must be started on the same physical computer as Bloomberg.

Choose more Functionalities

Of course, every MAX service includes our basic services, such as technical account management, support and personal assistance.

MAX has a modular structure. You can select your desired functionalities from the various services. Our experts will put together a product that is individually tailored to your needs.