MACD Conference 2023: Client interest in digital assets trading on the rise

More than 70 percent of the participants at this year's MACD Conference 2023 confirmed in a live survey that they are receiving more enquiries from clients about digital assets trading. Experts from InCore Bank AG, Sygnum Bank AG as well as Berner Kantonalbank AG analysed these results in the panel discussion, informed about possible ways of implementing and gave tips.

Speakers from Incentage AG and Inventx AG shared their knowledge on the important topics of 'Increasing Compliance Requirements in a Networked World' and 'Expanding Role of Technology in Banking'. George Macdonald, CEO MACD, rounded off the conference with some MACD News. As always, there was plenty of time for networking and sharing within the MACD community.

We will be happy to provide further results of the live survey and a summary of the presentations and panel discussion to members of the MACD community on request at macdnewsmacd.com. Here you can find the presentations for download:

Welcome to the MACD Community: ARTEX

In cooperation with ARTEX, the world's first art stock exchange, we offer all MACD customers the opportunity to trade a new, alternative asset class.

Art shares will take the form of standardized transferable securities, like shares listed on a stock exchange. ARTEX aims to democratize the fine art market, making it inclusive and accessible. Art shares will have an initial nominal value of EUR 100.

Yassir Benjelloun-Touimi, ARTEX Co-Founder and CEO: 'We have been relentlessly working on the launch of ARTEX for three years now. I am thrilled that our vision of democratizing iconic art investment has become a reality with the help of well-established stock exchange infrastructure service providers such as MACD. We look forward to a long term collaboration.'

Welcome to the MACD Community: Sygnum Bank AG

MACD now offers trading in cryptocurrencies and a variety of other digital assets in cooperation with Sygnum Bank AG. In addition to InCore Bank AG, Sygnum Bank AG is the second digital assets broker that we have the pleasure of welcoming to the MACD community.

Through the joint solution, we enable all MACD customers to automate trading and custody of digital assets via existing interfaces to their core banking systems.

Fritz Jost, Member of the Group Executive Board and Chief B2B Officer: 'More than 15 banks have already chosen Sygnum as a partner for their digital asset journey. Activation of 24/7 trading and custody via their existing order management system with a regulated market leader is a compelling value proposition. This fast time-to-market enables partner banks to access new revenue streams, increase their AuM with digital assets and expand the offering selectively over time thanks to Sygnum’s modular offering.'

MACD Golf Event

We organise our small golf tournament exclusively for members of the MACD community. This year we visit the Golfpark Otelfingen in the beautiful Furttal:

Golfpark Otelfingen

14 September 2023

T-Time: 14:20

Players of all levels are welcome. Beginners can take part in the golf beginner course. After golfing, we will finish the day with an apéro riche. Please register by e-mail to macdnewsmacd.com by Friday, 14 July 2023.

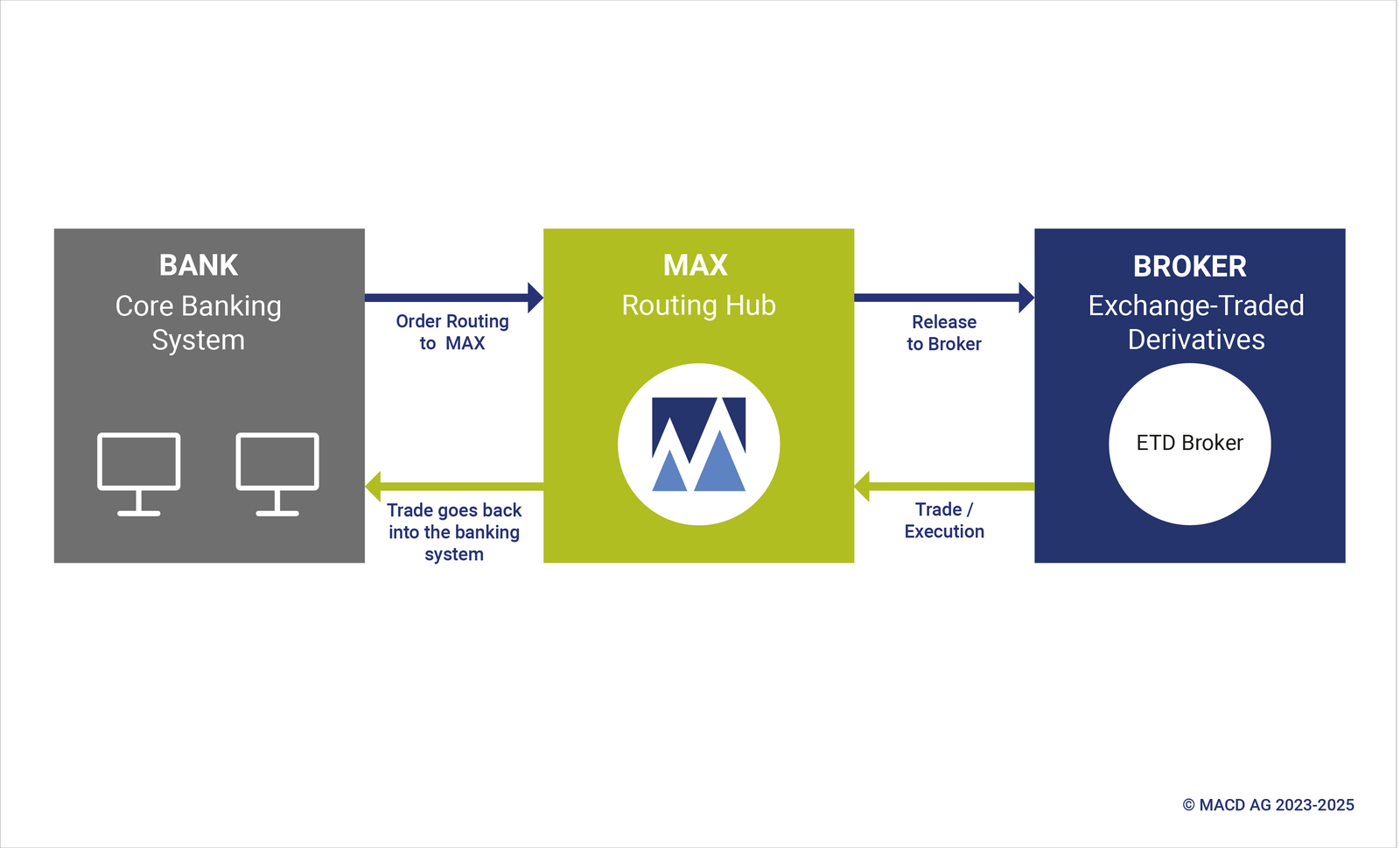

Fully Automated Solution with MAX ETD Trade

In cooperation with our brokers Berner Kantonalbank AG and Credit Suisse AG, MACD offers the routing of Exchange Traded Derivatives (ETDs). The MAX ETD Trade service enables all MACD customers to trade automatically via the existing interface to their core banking system.

Remo Kunz, Head of Trading, Berner Kantonalbank AG: 'We have been working closely with MACD since 2006. We have jointly implemented both the development of the electronic trading platforms for OTC|X and SME|X as well as connections to various stock exchanges and broker destinations, including the trading of exchange-traded derivatives (ETDs) on EUREX in 2013. Since 2022, our long-standing and experienced employees in the Derivatives / Foreign Equities trading team have also been offering the ETD business to all MACD clients so that they benefit from automated trading with a connection to the existing infrastructure.'

More and More MACD Banks use MACD Fund Trading Offer

Through new partnerships with various fund brokers, we have gradually expanded our fund trading offering in recent years and are seeing strong growth in this area. Currently, 14 banks handle their fund trading via MACD.

We always offer an individual solution tailored to the bank's needs. Both integration into the bank's internal system landscape and independent operation are possible. MACD already supports interfaces to various core banking systems, such as Avaloq, Finnova, Apsys or Finstar. Further interfaces can be integrated on request.

MACD Broker Program - Advantages for MACD Customers

MACD customers who work with one of the following brokers receive exclusive benefits, as these eight partners participate in the MACD Broker Program:

For example, MACD customers receive a reduction on the annual fees and minor changes are implemented by MACD free of charge.

Majority uses MAX

Last week, our customer Esprit Network went live with MAX via the Routing Hub with more than 20 connected banks. Meanwhile, 75 percent of our customers have successfully migrated to MAX.

With the increasing number of MAX customers, further synergies are opening up within the MACD network. This will enable us to provide an even wider range of MAX services to all MACD customers.

Lucas Fowler, Head of Software Engineering: 'MAX is based on future-oriented technology. With MAX Services, we can make the developed features available to all interested MACD customers in a timely manner.'

Kurt Meister, COO MACD: 'We are on track and making good progress. The switch to MAX is always done in close cooperation with the customer. We attach great value to a smooth transition. What is important to us is the quality and not the quantity of MAX migrations.'

MACD Customer Awarded Best Market Maker

On 5 April 2023, the Swiss Derivative Awards were presented to outstanding products or issuers. As in the previous year, our customer Luzerner Kantonalbank received the award for 'Best Market Maker' in the area of investment products. We are very pleased about this, as the bank uses MACD software to quote on the SIX Swiss Exchange.

Claudio Topatigh, Head of the Structured Products Competence Centre, Luzerner Kantonalbank AG: 'With MACD, we have a software provider on our side that provides us with excellent support in our market making activities, using state-of-the-art technology.'

We are looking for you

Join our team as

Business Project Manager

Sales & Account Manager

Technical Account Manager

Find out how we work at MACD and what you can expect here:

We look forward to receiving your application sent to jobsmacd.com.