On 6 June 2024, it was time again - our annual MACD Conference took place in Zurich. Around 90 people from 36 financial institutions from our community took part. Current and important topics were discussed, including sustainability in the financial sector, the advantages and disadvantages of cross asset class trading processes and self-regulation. In this follow-up report, you will find a brief summary of the afternoon.

Antoinette Hunziker-Ebneter (Gründungspartnerin, Forma Futura Invest AG und Präsidentin des Verwaltungsrates, Berner Kantonalbank AG) fokussierte sich in Ihrem Vortrag auf Nachhaltigkeitsthemen und gab dabei interessante Impulse, wie sich diese auch in der Finanzbranche umsetzen lassen könnten. Sie ging darauf ein, wie sich nachhaltige Geldanlagen in der Schweiz seit 2011 entwickelt haben und zeigte auf, wie sich eine Geldanlage nachhaltig gestalten lässt.

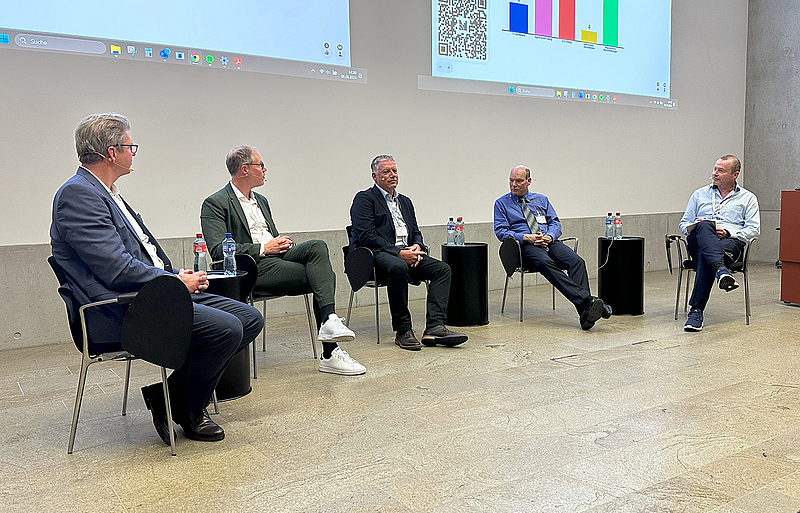

Afterwards, Peter Hollenstein (Partner, Revendex Solutions GmbH), Matthias Lötscher (Head of Trading, Dreyfus Sons & Co Ltd, Banquiers), Claudio Tognella (Director of Sales & Business Development, BX Digital AG) and Eric Trummer (Head Derivatives / Foreign Equities, Berner Kantonalbank AG) discussed the advantages, disadvantages and challenges of a cross asset class connection to new trading destinations. The advantages of a cross asset class trading system included a reduction in the technical complexity of the connection and the possibility of being able to implement the connection to new trading destinations quicker. However, as an audience survey at the beginning of the expert panel highlighted, there is still a need for action, particularly with regard to regulatory requirements and the asset classes exchange-traded derivatives (ETDs) and digital assets.

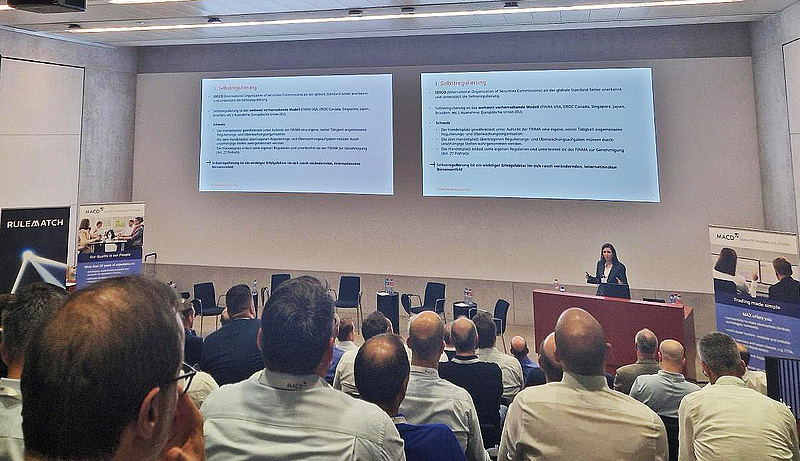

After the coffee break, Sophia S. Ramphos (Head Enforcement & Compliance, SIX Exchange Regulation AG) gave a presentation on the regulation of stock exchange trading in line with the survey results. The expert spoke about self-regulation and the legal and regulatory basis for trade monitoring.

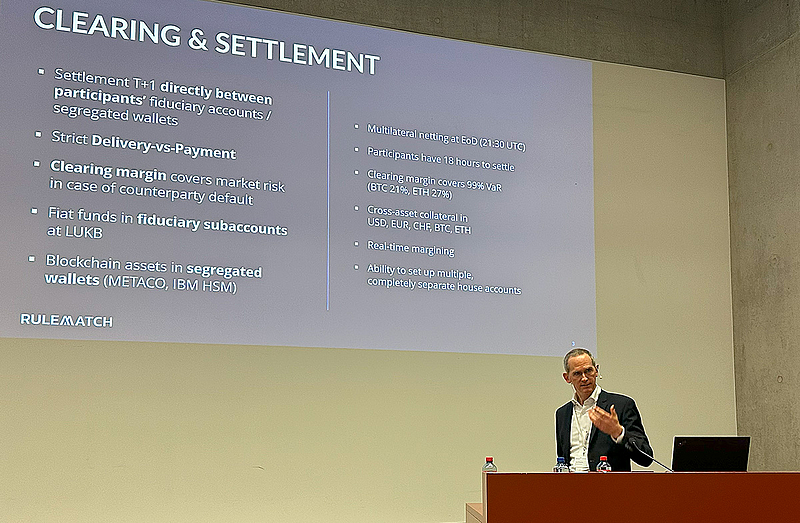

In a short presentation, David Riegelnig (Co-Founder and CEO, RULEMATCH AG) introduced RULEMATCH, a crypto trading centre for institutional clients. As a market operator, it brings together the selling interests of participants and handles clearing and settlement between them. If you are interested in connecting to RULEMATCH, please contact us by writing an email to sales@macd.com.

Finally, as every year, George Macdonald (CEO, MACD) gave an update on the latest developments at MACD. Since last year, two new clients and four new partners have joined the MACD community. Among others, MACD has been cooperating since last summer with Sygnum Bank AG for trading digital assets on an institutional level and ARTEX MTF AG, the world's first art stock exchange.

New services have also been added to our MAX trading system, such as Business Oriented Testing. Automatic testing of the individual phases of the trading process is not only faster and more efficient than manual testing, but also less risky, as both the expected and the actual system behaviour are precisely documented.

Many thanks to all participants! Our special thanks goes to the experts for their interesting input. If you have any questions or suggestions, please send an e-mail to marcom@macd.com. We will also be happy to establish connections with the experts.