Digitalisation of order transmission for external asset managers (EAM)

Tomas Fort - 29th of May 2020

For MACD, the buzzword digitalisation is not new, but one of the main aspects of our daily work. Efficient connectivity and the complete electronic transport of messages between financial players is our core business.

Thanks to our customers and partners, some of whom have been using MACD for more than 20 years, we are able to offer a range of products that help make securities trading at many trading desks more efficient, secure and flexible.

We primarily connect our clients' banking systems (Avaloq, Finnova, Apsys, Finstar, Olympic etc.) with their trading destinations (stock exchanges, brokers, broker networks), reduce manual entries, and increase straight through processing (STP).

We provide know-how and tailored software tools to enable exchange traders to meet complex customer requirements and increasing regulatory demands while at the same time pursuing innovative approaches to trading.

EAM with high digitalisation potential

The banks in Switzerland and Europe have always been under pressure due to regulation and for efficiency reasons, so that they have automated as many manual processes as possible.

For the most part, other players in the financial market still have this step ahead of them, including the external asset managers (EAM).

There are various reasons for this:

- The asset manager is limited to advisory activities while account management and trading is delegated to a bank.

- Until recently, regulatory changes in trading with foreign exchange and securities products mainly affected banks and securities dealers (responsible for transactions).

- Software products such as portfolio management systems for external asset managers focus on portfolio management.

- Due to the (initially) limited number of transactions and lack of software providers, the choice between a manual solution (personnel costs) and an investment in improving IT systems was always made in favour of the manual process.

Even today, hundreds of asset managers still manually transmit the transactions from their investment decisions to the banks, in some cases using very outdated, error-prone and hardly customer-oriented methods.

The orders are transmitted, for example, by telephone and with Excel spreadsheets by e-mail or an employee of the EAM transmits the transactions by means of the customer's e-banking token/login.

Zuger Kantonalbank digitally connected with EAM for the first time

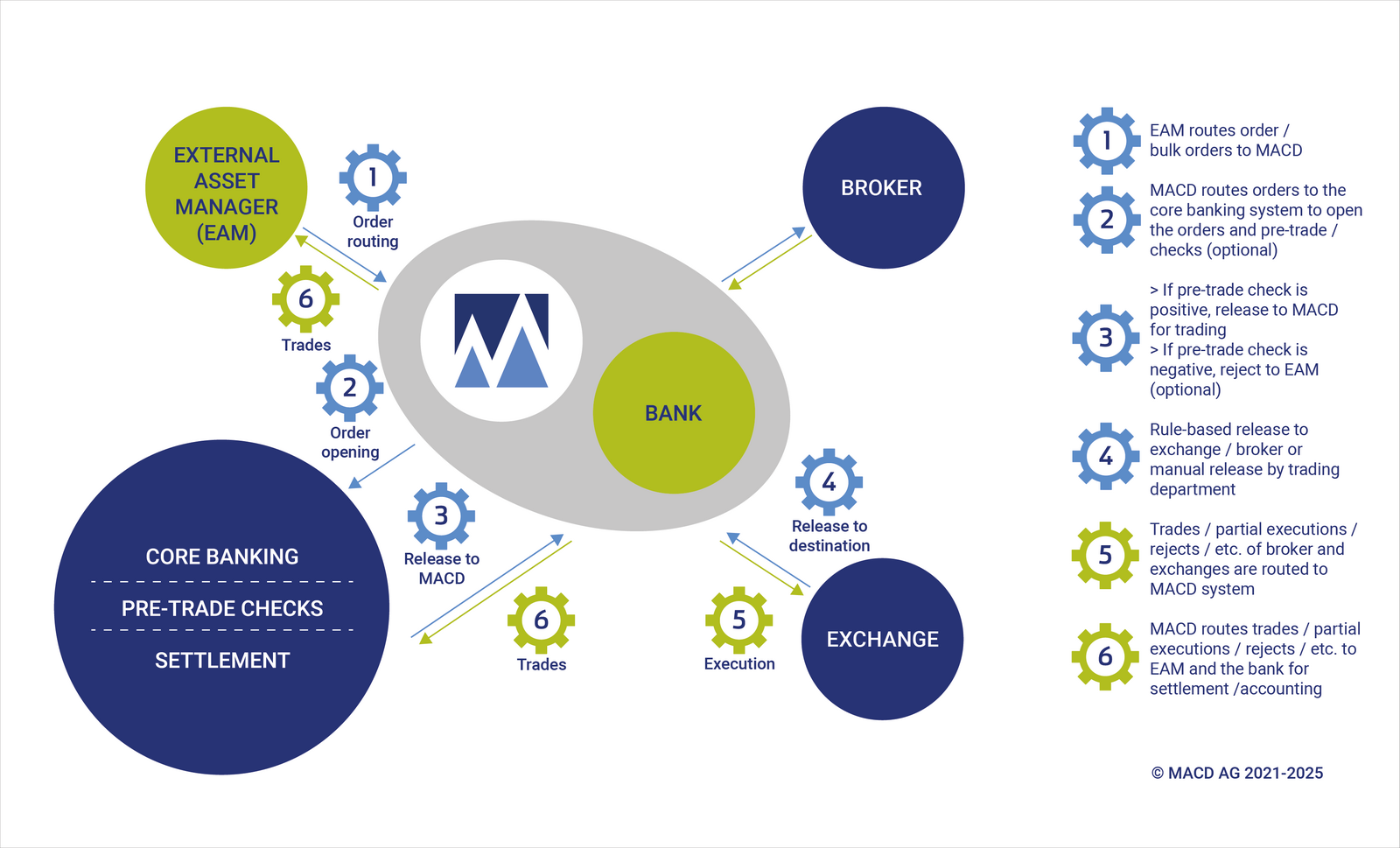

We recognised the digitalisation potential and were able to connect an EAM to the pilot customer Zuger Kantonalbank via our system at the end of 2019. The EAM now sends its customers' orders electronically directly from its portfolio management system via the MACD system to Zuger Kantonalbank in order to carry out the corresponding pre-trade/suitability checks.

As soon as these have been completed, the orders are forwarded to the trading department, where they are automatically traded worldwide or traded by the correspondent bank's trader, subject to various trading checks.

The status of the orders (placed, partially executed, deleted, rejected, ...) is displayed to the executing bank/EAM and the MACD system ensures that the EAM is also always informed about the status of its orders.

The trades are communicated to both parties so that settlement is initiated and the portfolio management system can make the corresponding bookings.

Video

In the animated graphic you can see the process of order sending, forwarding, approval and execution:

Many advantages for EAM customers

The new automated process has considerable advantages for all stakeholders in the chain, but especially for the end customers of EAM:

Since we have been offering this new service, numerous MACD customers, EAM and other banks have already shown interest in an EAM customer solution. The solution I have described, which we are currently able to implement, also works for other institutional customers, such as pension funds.